Climate Risk Management

Building capabilities, tools, and processes to understand climate risk exposure and optimize adaptation and mitigation strategies

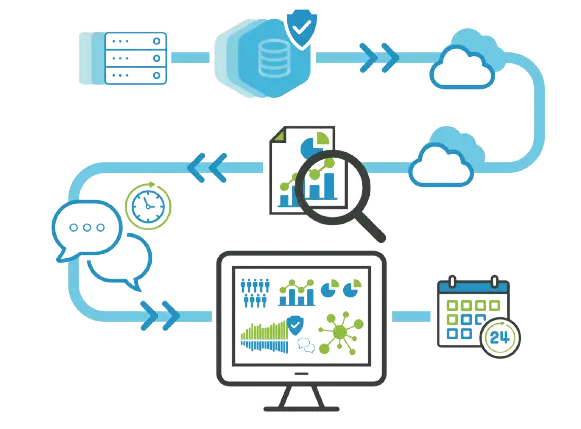

WorkBuilding resilience against climate-related risks requires organizations to address vulnerabilities in their business model, their overall operations, and ultimately their balance sheet.

FINANCE FOR IMPACT supports financial institutions in assessing climate-related risks and opportunities, and managing and reducing their financed emissions to reach net zero.

We work with national and local governments, financial institutions, and companies to assess their exposure to climate risks. We model the impact of a broad range of physical and transition-related climate risks, based on the latest climate models, data, and research. We support the design of ambitious climate adaptation and resilience strategies. We help mobilize funding in order to build maximum protection for people, the economy, and natural ecosystems.

Specialty Areas

Discover our Case Studies

Global

EUROPEAN BANK FOR RECONSTRUCTION AND DEVELOPMENT (EBRD) AND GLOBAL CENTER ON ADAPTATION (GCA)