About

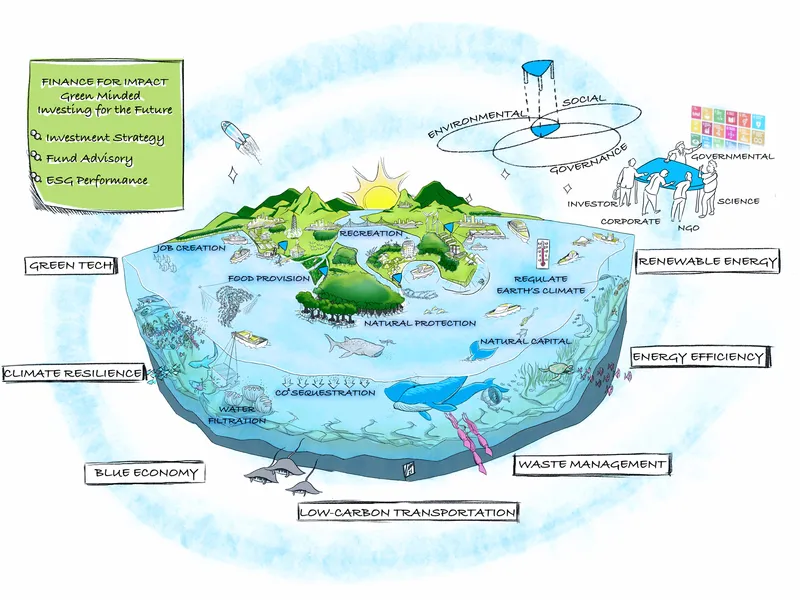

We define, shape, and implement impactful green climate investment solutions.

Who we are

FINANCE FOR IMPACT is a green investment advisory firm operating across frontier and emerging markets globally. We provide tailored and innovative financial solutions for structuring green strategies, funds, and portfolios.

Sustainability is at the core of what we do.

GLOBAL OUTREACH

60+

Countries of intervention, from Bhutan and Equator to Botswana and USA

MARKET ACCEPTANCE

1500+

Financial institutions, regulators, government agencies, and corporates serviced by our teams

DESIGN CAPABILITIES

30+

Metrics, scoreboards, and indices created to provide sustainability intelligence

SCALING UP INVESTMENT

USD15 billion

Investment advisory services helping to scale up major investment schemes

Our story

We have a history and passion for helping our clients to scale up their investment in green and climate markets, in which financing gaps are high and the potential to serve vulnerable populations is strong.

Passionate about innovation, obsessed with numbers, and dedicated to sustainability, our founding team developed investment models and metrics to generate positive impacts.

Our management

Experienced, focused and approachable.

FINANCE FOR IMPACT brings together decades of sustainability investing and green finance knowledge. At every level of our organization, we strive to put our clients in a position to succeed.

Thierry Senechal founded FINANCE FOR IMPACT after graduating from MIT (MBA) and Harvard Kennedy School (MPA). Learn more from our Director…

Our approach

Green investing is no longer a niche area; it is going mainstream. The demand for such investment will accelerate—driven by societal needs.

The ecological transition cannot be constructed exclusively upon the imperative of economic efficiency. This is why we always adopt a holistic and multidimensional approach in our work, taking into account the social, climate and environmental imperatives.

Our key benefits

We equip clients with the insights and analytical tools they need to successfully perform in green and climate markets.

Deep Sector Knowledge

Our experts have strong experience in advising clients on green investment strategies driving operating results and innovation.

Client-Oriented

We have global experience with investors, financial institutions, central banks, regulatory agencies and investment funds. A 'one-size-fits-all' solution cannot work so we always adapt our delivery model to market conditions and client needs.

Market Intelligence

We assess investment needs, gaps, and failures. In doing so, we always provide structured problem-solving and evidence-based analysis.

Innovation

We support our clients by designing investment strategies that foster innovation and entrepreneurship. This is our strongest asset.